The most recent update on US housing shows that the market kept up its considerable momentum through July, even though mortgage rates have shot higher in recent weeks from their all-time lows.

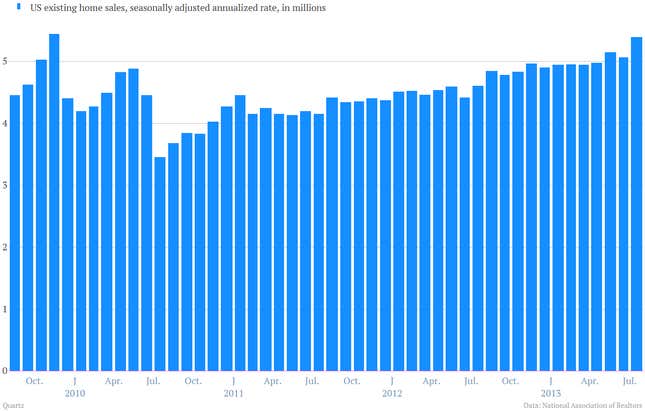

Sales of existing homes hit an annual pace of 5.39 million in July—the fastest level since 2009, according to the always-disinterested National Association of Realtors…

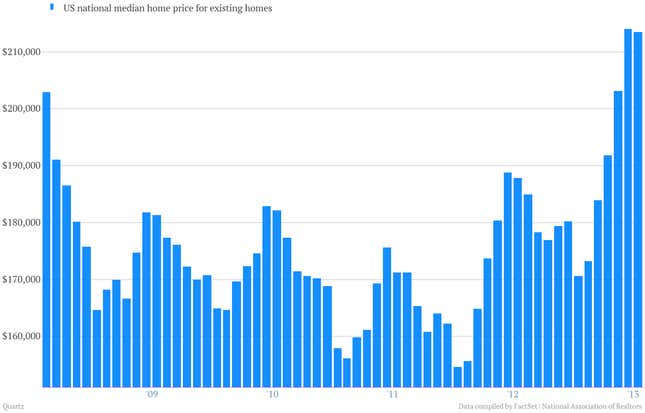

And prices, which this year have been zooming up beyond pre-crisis levels, didn’t fall much in July to keep sales rising. The median existing home went for around $213,500…

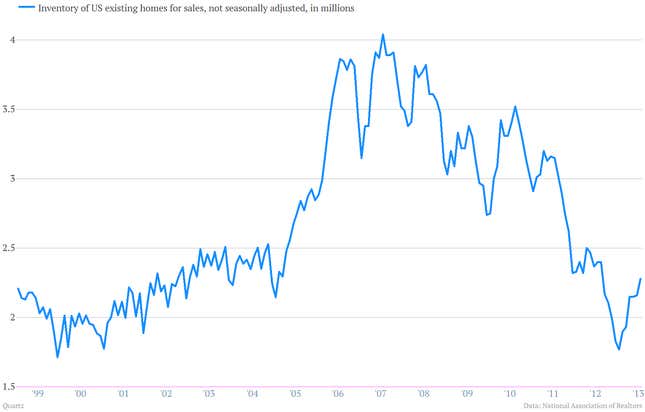

Meanwhile, inventories have been starting to build a bit. (Thought they’re still tight by recent standards.)

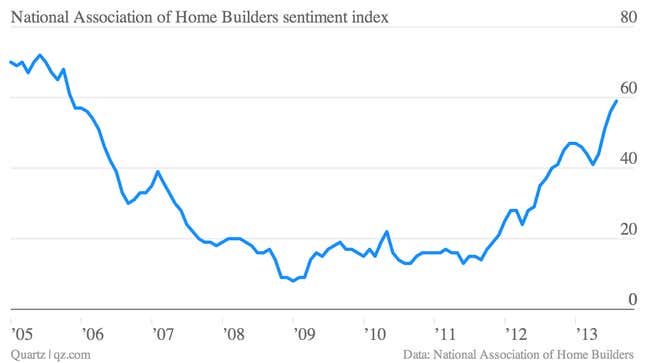

That rise in inventory—which in theory should reflect strength in underlying demand—helps explain why homebuilder sentiment has been so buoyant lately.

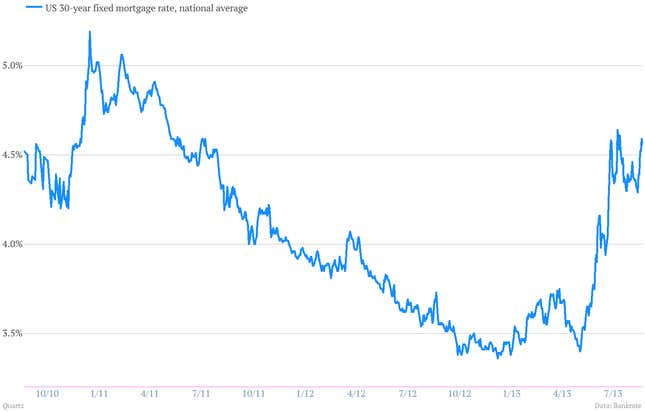

Of course, there’s a fly in the ointment: the recent sharp rise in mortgage rates. The average rate for a 30-year fixed mortgage —that cherished national quirk of the US—jumped from below 3.5% to over 4.5% in a matter of weeks. (Though that’s still very low by historical standards. In the late 1990s, rates fluctuated between 7% and 8%.)

This rise in rates was, of course, brought on by the US Federal Reserve’s hints that it may start tightening monetary policy by cutting back on its bond-buying program as early as next month. However, the rise in rates may not yet have had its knock-on effect on sales, because most homebuyers in the US lock down a mortgage rate weeks or even months before the sale is closed. (Morgan Stanley analysts note that most of the sales reflected in today’s number went into contract back in May.)

So, we’ll have to wait for August’s or even September’s data to know whether the housing market is so robust that even higher mortgage rates don’t dent it.